Can I Rent Out My Granny Annexe? Legal Guide

Wondering if you can rent out your granny annexe for additional income? This comprehensive guide explores the legal requirements, planning permissions, and potential restrictions you need to know before listing your garden annexe for rent.

What Does The Law Say About Renting Granny Annexes?

Source : Granny Flat Kit Homes & UK DIY self-build SIP log cabin kits

The legal position on renting out your granny annexe in the UK isn’t always straightforward. In principle, you can rent out a properly approved annexe, but several legal factors determine whether this is possible for your specific property. The primary consideration is the planning classification of your annexe and any conditions attached to its original planning permission.

Most granny annexes are approved under Class C3 (dwelling houses) of the Town and Country Planning Use Classes Order. However, many are approved with a specific condition that the annexe must be used as ‘ancillary accommodation’ to the main dwelling. This typically means it should be used by family members or those with a direct connection to the main household.

If your annexe was approved with such a condition, renting it out to unrelated third parties would likely require:

- A planning application to remove or vary the condition

- Potential change of use application if the rental purpose differs significantly from the approved use

- Compliance with additional building regulations specific to rental properties

It’s worth noting that enforcement against improper annexe rentals has increased in recent years, with local authorities taking a more active approach to ensure compliance. Penalties for unauthorised rentals can include enforcement notices, fines, and potentially being required to restore the annexe to its approved use.

Planning Permission Requirements For Annexe Rentals

Source : Planning Geek

Converting your family annexe into a rental property often requires specific planning considerations. The key distinction in planning terms is whether you’re changing the use of the annexe from its original purpose. Most granny annexes are built with planning permission that specifies they are for use by family members or those connected to the main household.

To rent out your annexe legally, you may need to apply for:

- Removal of an occupancy condition – if your original permission restricts who can live in the annexe

- Change of use application – particularly if moving from C3 (dwelling house) to potentially C1 (hotels, guest houses) for short-term lets

- Certificate of Lawfulness – if you believe the annexe already has the correct permissions for rental use

- Building regulation compliance certificate – ensuring the structure meets all safety standards for rental properties

The planning process typically takes 8-12 weeks, and application fees vary by local authority but usually range from £200-£500. Success rates for these applications vary significantly depending on local housing policies, with some councils being more supportive of annexe rentals than others, particularly in areas with housing shortages.

How To Check If Your Granny Annexe Has Rental Approval

Source : Family Annexe

Before listing your annexe for rent, it’s crucial to verify whether your existing structure already has the necessary approvals. Follow these steps to determine the rental status of your annexe:

First, locate your original planning permission documents. These will contain any conditions related to occupancy or use. Look specifically for terms like ‘ancillary accommodation’, ‘incidental to the enjoyment of the main dwelling’, or any clauses mentioning family occupation requirements.

If you don’t have these documents, you can:

- Search your local authority’s planning portal using your property address

- Contact your council’s planning department directly to request copies of planning decisions

- Review property deeds which sometimes contain restrictions on annexe use

- Check if previous owners obtained any Certificates of Lawfulness that might permit rental use

If there’s any ambiguity about your annexe’s status, consider applying for a Certificate of Lawful Use from your local authority. This provides formal confirmation of whether your proposed rental use is lawful. The application costs approximately £103 (for 2024) and typically takes 8 weeks to process. While not legally required, this certificate provides valuable protection against future planning enforcement action.

Short-Term Letting Options For Your Garden Annexe

Source : Family Annexe

Short-term letting through platforms like Airbnb or Booking.com offers a potential middle ground for annexe owners who want rental income without committing to long-term tenants. This approach provides flexibility and often higher nightly rates compared to traditional rentals. However, it comes with its own set of regulations.

In the UK, short-term letting of your annexe is subject to:

- The 90-day rule in London – restricting short-term lets to 90 nights per calendar year (unless you obtain planning permission for change of use)

- No nationwide limit outside London, though some local authorities have introduced their own restrictions

- Potential need for planning permission if the short-term letting represents a ‘material change of use’

- Requirement to meet safety standards including fire safety regulations, Gas Safety certificates, and electrical safety checks

The advantage of short-term letting is that it may be viewed more favourably by planning authorities than permanent rentals, as the intermittent use more closely resembles ‘ancillary accommodation’ than creating a separate dwelling. According to industry data, garden annexes in popular tourist areas can generate between £70-£150 per night depending on size, quality and location.

Some councils offer a ‘mixed use’ permission that allows both family and occasional guest use, which might be an easier approval to obtain than full commercial rental permission.

Tax Implications When Renting Out Your Annexe

Source : My Tax Accountant

Renting out your granny annexe creates several tax considerations that must be properly managed. The tax treatment varies depending on whether the annexe is structurally part of your main home or a separate building, and how the rental is structured.

For income tax purposes, rental income from your annexe must be declared to HMRC. However, you may be eligible for certain tax reliefs:

- Rent-a-Room Scheme – If the annexe is part of your main property (connected internally), you can earn up to £7,500 tax-free annually

- Property Allowance – If the annexe is separate, you can use the £1,000 property allowance against your rental income

- Expenses deduction – Costs directly related to renting the property (maintenance, insurance, agent fees) can be deducted from your rental income

- Furnished Holiday Letting tax benefits – If meeting specific criteria for short-term lets, you may qualify for more favourable tax treatment

Capital Gains Tax (CGT) implications are particularly important to consider. If you sell your property in the future, renting out part of it could affect your Principal Private Residence (PPR) relief. The proportion of your property used exclusively for rental purposes might be subject to CGT on sale.

Additionally, if your rental income exceeds £85,000 annually, you’ll need to register for VAT, though this threshold is unlikely to be reached with a single annexe rental.

Insurance Considerations For Rented Granny Annexes

Source : Family Annexe

Converting your annexe from family use to a rental property necessitates a comprehensive review of your insurance coverage. Standard home insurance policies typically don’t provide adequate protection for rental scenarios, leaving you potentially exposed to significant financial risks.

When renting out your granny annexe, you’ll need to consider:

Landlord insurance is essential, as standard home insurance won’t cover rental activities. This specialist coverage protects your property during tenant occupation and typically includes buildings insurance, property owner’s liability, and options for contents insurance if you’re providing a furnished annexe.

Public liability insurance becomes particularly important when having tenants on your property, protecting you if someone is injured in your annexe. Most landlord policies include this, but check the coverage limits meet your needs.

Consider additional coverage options such as:

- Rent guarantee insurance – protecting against loss of rental income if tenants stop paying

- Legal expenses cover – for potential disputes with tenants

- Accidental damage protection – particularly important for short-term lets with frequent changeovers

- Malicious damage by tenants – not always included in standard policies

- Alternative accommodation costs – if your annexe becomes uninhabitable

Failure to inform your insurer about rental activities could invalidate your entire home insurance policy, not just coverage for the annexe. Always notify both your buildings and contents insurance providers before starting any rental arrangement.

Local Authority Regulations That Affect Annexe Rentals

Source : Hawksbeck Annexes

Beyond national planning laws, local authorities across the UK have significant discretion in how they regulate granny annexe rentals. This creates a patchwork of different approaches that requires careful navigation for potential landlords.

Local council policies that might affect your annexe rental include:

Council Tax liability varies significantly between authorities. Some councils will register the annexe as a separate dwelling for Council Tax purposes once it’s rented out, while others maintain it as part of the main property. This decision can have substantial financial implications, potentially adding £1,000-£2,000 in annual costs.

Housing standards enforcement also varies by region. Most councils require rental properties to meet minimum standards for:

- Fire safety – including smoke alarms, carbon monoxide detectors, and fire-resistant doors

- Energy efficiency – with a minimum EPC rating of E required for all rental properties

- Electrical safety – requiring EICR (Electrical Installation Condition Report) certification

- Space standards – minimum size requirements for habitable rooms

Some authorities have introduced additional licensing schemes for rentals, including Article 4 Directions that restrict permitted development rights in certain areas. Around 70 councils across England have implemented selective licensing schemes that require all private rental properties to be licensed, which may include granny annexe rentals.

To navigate these regulations effectively, contact your local authority’s planning and housing departments directly before proceeding with rental plans. Many councils offer pre-application advice services that, while sometimes carrying a fee, can provide valuable clarity on local policies.

What Are The Financial Benefits Of Renting Your Granny Annexe?

Source : Hawksbeck Annexes

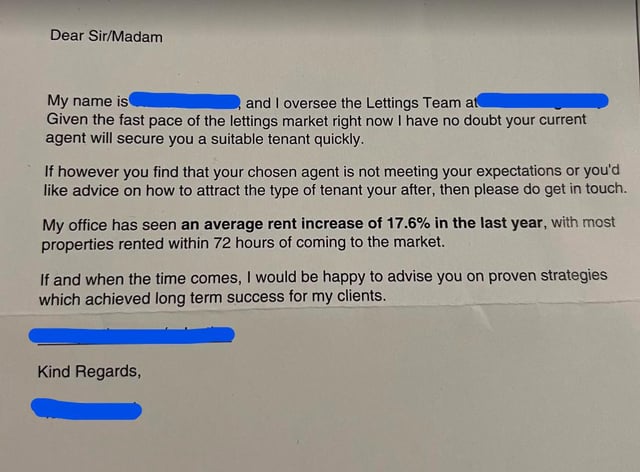

Converting your garden annexe into a rental property can create a substantial new income stream that might significantly improve your financial situation. The potential returns vary based on your location, the quality of the annexe, and your chosen rental approach.

Long-term rentals offer stability and predictable income. In the current UK market, a well-appointed one-bedroom annexe might generate:

- London and South East: £800-£1,500 monthly

- Major cities outside London: £600-£900 monthly

- Rural areas: £500-£800 monthly

Short-term holiday lets potentially offer higher returns but with less stability and more management involvement. According to industry data, the average occupancy rate for UK holiday lets is around 70% annually, with peak season rates often double or triple the long-term rental value.

When calculating potential returns, consider these factors:

Initial investment costs include any planning application fees, building modifications to meet rental standards, furnishing costs if offering a furnished let, and professional services like legal advice or energy assessments.

Ongoing costs will include maintenance (budgeting approximately 1% of property value annually), insurance premiums (typically 20-40% higher than standard home insurance), potential management fees if using an agent (usually 10-15% of rental income), and tax obligations.

Despite these costs, many annexe owners report net yields of 4-7% annually, making it a potentially more lucrative investment than many savings accounts or investment funds in the current market. Additionally, the property itself may appreciate in value, adding to the long-term return on investment.

Common Legal Pitfalls When Renting Out Annexes

Source : Summerhouse24

Even with the best intentions, annexe owners often make costly legal mistakes when venturing into the rental market. Being aware of these common pitfalls can help you avoid significant problems.

One of the most frequent errors is failing to secure proper planning permission before renting. Many owners proceed based on incorrect assumptions about their annexe’s planning status, leading to enforcement action and potential fines. Always verify your planning status and apply for necessary permissions before marketing your property.

Other common pitfalls include:

- Inadequate tenancy agreements that don’t properly protect your interests or clarify responsibilities

- Failing to complete proper tenant referencing, leading to payment problems or property damage

- Not protecting tenant deposits in a government-approved scheme (legally required for assured shorthold tenancies)

- Neglecting to provide tenants with mandatory documentation such as How to Rent guides, Energy Performance Certificates, and gas safety certificates

- Incorrectly handling maintenance responsibilities and emergency repairs

- Breaching tenant privacy through improper access to the annexe

Research shows that over 40% of UK landlords have faced issues due to incomplete paperwork or misunderstanding their legal obligations. The consequences range from inability to evict problem tenants to financial penalties and even criminal charges for serious safety breaches.

A key consideration often overlooked is the relationship between the annexe and main dwelling. Proximity can create unique challenges around privacy, utilities management, and boundary issues that should be clearly addressed in your rental documentation.

When Should You Seek Professional Advice About Annexe Rentals?

Source : Reddit

While this guide provides a foundation for understanding annexe rentals, certain situations warrant professional guidance to navigate complex legal and financial landscapes. Recognising when to seek expert advice can save you significant time, money and stress in the long run.

Professional advice becomes particularly valuable in these scenarios:

Complex planning situations require specialist input, especially if your original annexe permission contains restrictive conditions or if you’re facing resistance from the local planning authority. A planning consultant with experience in residential annexes can develop strategies to overcome planning hurdles and improve approval chances.

Tax planning opportunities may be overlooked without professional advice. A tax advisor can help structure your rental to maximise available reliefs and allowances, potentially saving thousands in tax liabilities, particularly if you have other rental properties or complex income sources.

Consider seeking professional advice when:

- Your annexe has unusual features or a non-standard planning history

- You’re considering short-term lets in areas with specific local restrictions

- The annexe represents a significant portion of your property’s value

- You have a mortgage on your property that might prohibit rental activities

- You’re planning to sell the property in the near future and need to understand CGT implications

- The annexe and main dwelling share utilities or other services that need formal allocation

Professional advice typically costs between £150-£300 per hour for legal or planning consultants, and £200-£500 for a comprehensive tax review. While representing a significant investment, this expertise often delivers substantial returns through avoided penalties, optimised tax arrangements, and successful planning outcomes.

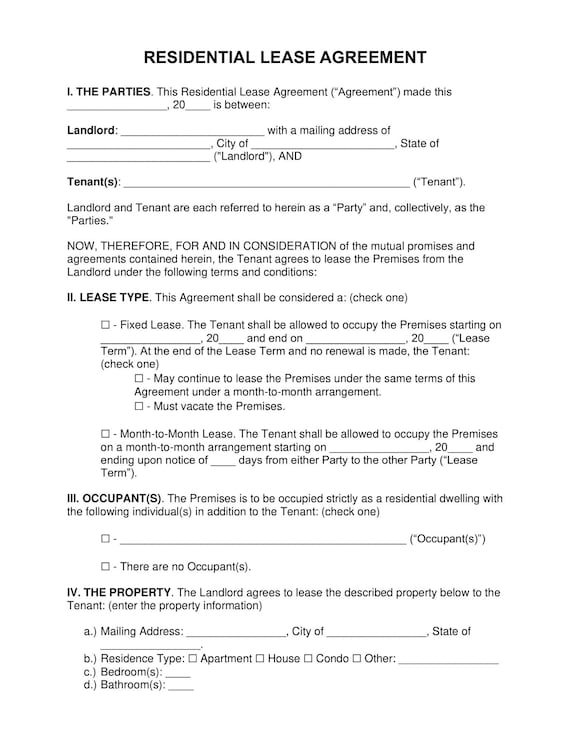

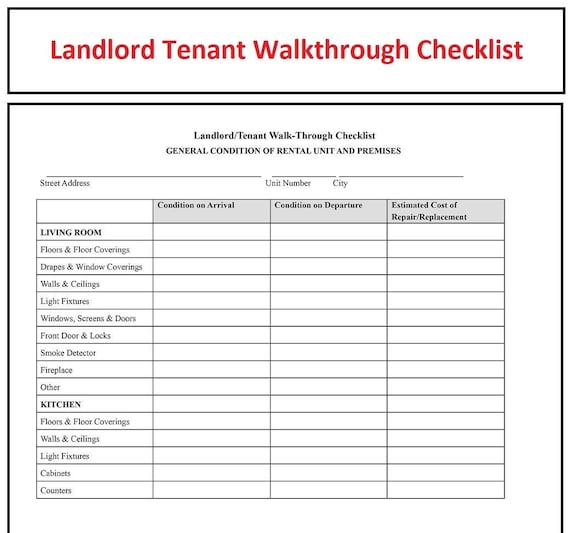

Final Steps Before Listing Your Granny Annexe For Rent

Source : Etsy · In stock

Once you’ve navigated the legal framework and made necessary preparations, a few final critical steps will ensure your annexe rental launch proceeds smoothly and remains compliant with all regulations.

Creating proper documentation is essential for protecting both you and your tenant. This includes:

- A comprehensive tenancy agreement tailored to annexe rental (standard templates may need modification)

- Inventory and condition report with detailed photographs

- Written confirmation of planning permission status and any applicable conditions

- Clear policies regarding shared spaces, parking arrangements, and utility responsibilities

- Emergency contact information and property maintenance procedures

Practical preparations should include a thorough safety assessment of the annexe. Research indicates that property safety issues account for over 30% of disputes between landlords and tenants, so ensuring all systems are properly maintained and certified is crucial.

Install and test smoke alarms and carbon monoxide detectors where required. Arrange for gas and electrical safety certificates from qualified professionals. Consider having the annexe professionally cleaned before tenant occupation to establish cleanliness standards.

Final administrative tasks include setting up a proper rent collection system, arranging for deposit protection, and notifying relevant authorities about the new rental arrangement. Your buildings insurance provider must be informed, as should your mortgage lender if applicable.

Remember that becoming a landlord creates ongoing legal obligations. Maintain a calendar of required inspections, certificate renewals, and tenancy milestones to ensure continuous compliance throughout the rental period. With proper preparation and management, your granny annexe can become both a valuable income source and a positive experience for all parties involved.

FAQ

What are the requirements to rent a storage?

You will need to bring a government issued ID to complete your storage unit rental. If you choose our easy pay option, which is our most convenient payment method, you’ll also need a credit card.

How much should I charge to rent out my garage?

Factor #1: Location and Its Impact on Average Garage Rental Rates

Can you write off storage rental?

If you’re using a storage unit for business, you’re in luck! The IRS generally allows you to deduct storage unit expenses if they are “ordinary and necessary” for your business operations. This can include storing: Inventory: Excess stock, seasonal items, or raw materials.

Can I rent out storage on my property?

Yes. Generally, you have the right to rent out any part of property in your possession, including property that you own as well as property that you rent yourself. That said, if you rent, check your Lease Agreement.

Do I need permission for a granny annexe?

When planning to build a granny annexe for a family member, you’ll typically need to apply for Full Householder Planning Permission and comply with Building Regulations. However, an alternative option is to choose an annexe that complies with the Caravan Act, which can streamline the approval process.

Sources

[1] https://www.martinco.com/guides/landlord/can-i-rent-out-my-annexe/ [2] https://community.withairbnb.com/t5/Ask-about-your-listing/Granny-flat-Annexe-planning/m-p/1576823 [3] https://www.haart.co.uk/landlords/landlord-advice/can-i-rent-out-my-annexe/Need Fencing Advice?

Let's discuss your fencing project. Oakley Fencing offers expert solutions in SE London & North Kent.

Get Your Free Fencing Quote